Bond

The Evolution of Loyalty: Loblaw PC Optimum and its Implications

Back in 1997 when I began to lead a loyalty project for Shoppers Drug Mart with the code name “ASA” (an acronym for Acetylsalicylic acid), little did I know that 20 years later we would be witnessing the evolution of Canada’s favorite and most successful loyalty program. This past week’s announcement of the merger of these two iconic loyalty programs makes great business sense for the brands and their customers. The Shoppers Optimum program was originally tested in Kingston, Halifax and Calgary over a 16-month period. Towards the end of the pilot in 1999, approval was granted to launch the Shoppers Optimum Program nationally.

Shoppers Optimum, the envy of every retailer

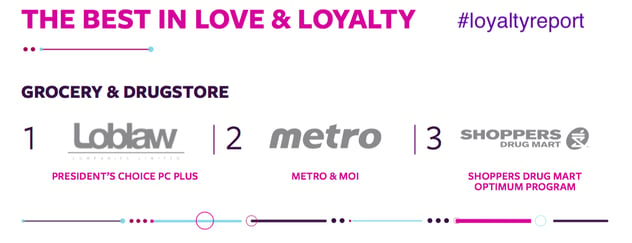

The launch of the Shoppers Optimum Program became the sole priority of the company – from the CEO to the front line cashiers. The launch represented the largest financial marketing investment in the company’s history and it became an instant hit with customers, reaching its first-year enrollment goal of 4 million members in the first 3 months. The program exceeded all pilot metrics and roll-out expectations and quickly became the envy of every retailer and brand in the country. The key to its success was the simple design, strong value for customers, its impeccable technical delivery, and the infectious passion for the program by all employees. To this day, 17 years after rollout, Shoppers Optimum continues to be a loyalty leader according to Bond Brand Loyalty’s 2017 Loyalty Report.

With over 11 million members today, Shoppers Optimum has the largest marketable female database in the country, which is one of many reasons why Shoppers Drug Mart was viewed as such a lucrative acquisition for Loblaw. The recent decision by Loblaw to merge its highly successful, eight-million-member-strong PC Plus program with Shoppers Optimum has been speculated since the announcement of the acquisition of Shoppers Drug Mart in 2014. It was likely put on hold to manage internal and external change within both organizations during the initial merger period. Getting this union right was of paramount importance given the love for these programs. There was too much at risk to rush this important program evolution.

Benefits of the Program merger

Loblaw will now be in the enviable position of realizing even greater benefits with this program evolution and new name. Here are some of the key benefits they can expect to reap:

- A full 360-degree view of all transactional and non-transactional data for all Shoppers and Loblaw loyalty members which will enable them to retain and grow the transactional and emotional relationship with these customers and help defend against other grocery/pharma and e-commerce competitors.

- Sizeable cost savings due to a reduction in the duplication of loyalty marketing, operations, technology, analytics infrastructure, activities and resources

- Improved negotiation clout with vendors to increase subsidization of loyalty points and marketing communications costs.

- Acquisition opportunity to move Shoppers Optimum members to transact at Loblaw and vice versa by leveraging the currency as a means to induce point collection and banner trial through reward redemption.

- Householding accounts will allow for enhanced personalization within the household

For customers, the benefits will be plentiful as well:

- One App (or card) will bring greater convenience to members of both programs, especially given the high duplication of participation in both programs, which is estimated to be more than 50%.

- New ways to earn a common currency across all Shoppers Drug Mart/Pharmaprix stores and Loblaw grocery banners.

- A higher rate of earn at Shoppers/Pharmaprix to compensate for a richer rewards dividend rate currently at Shoppers.

- Expanded redemption options across all Shoppers /Pharmaprix stores and Loblaw grocery banners.

- Expanded promotional earning opportunities to collect a common currency faster.

- Ability to household accounts and earn rewards faster.

- New levels of personalization which will address a wider spectrum of members’ shopping needs.

It’s a win-win

Sounds like a win-win value exchange between customers and Loblaw/Shoppers Drug Mart. While this does not begin until February 1, 2018, one can speculate that there may be a run on the points bank. Shoppers Optimum Members might be more inclined to redeem their points prior to this merger since the Shoppers Optimum Program redemption thresholds are lower than the new PC Optimum Program.

Keeping a close eye on the competition

We expect that the marketplace will be watching this event closely and competitors are likely retrenching to determine how to mitigate the great fanfare which this evolved program will elicit. We contemplate that grocery brands will be looking for ways to forge common proprietary loyalty consortiums. Most notably Metro, who has seen much success with its Metro et Moi program in Quebec and with the recent acquisition of Jean Coutu, will be watching this program evolution with much interest. Time will tell, but time is not on the side of grocers with the forces of Amazon and other formidable competitors. Customers have high expectations when it comes to loyalty programs, and with the propagation of loyalty programs in the marketplace, brands must evolve and innovate their programs to stay relevant with their customers.

Broadening the loyalty experience

We are witnessing changes in the loyalty industry beyond the amalgamation of sizeable programs. These advancements encompass new features, mechanics, and currencies, and Loyalty programs are increasingly playing a key role across the enterprise of many brands. A great example is Amazon Prime which has been a leader in the “pay-to-play” loyalty program sector and most recently announced “Amazon Key” which permits a courier to unlock a member’s front house door to drop off an ordered package. This is just one example of how loyalty experiences are being broadened into new territories. We have also been witnessing the spread of “informal loyalty” initiatives which mimic the mechanics of formal loyalty programs without the program branding and commitment normally associated with well-known loyalty programs. Apple and Tesla are just a couple of brands that use loyalty-like mechanics to upsell, cross sell and provide serendipitous brand experiences, while capturing and utilizing data to create exceptional brand experiences in the absence of a formal loyalty program.

The loyalty landscape has changed since the launch of Shoppers Optimum on September 10, 2000. We applaud Loblaw for evolving to a PC Optimum merger and are confident that the goodwill engendered through both programs will continue to pay great dividends in their newest incarnation as PC Optimum. Loblaw will need to continue to stay close to its customers’ needs and work diligently to keep innovating in what is one of the most competitive retail and loyalty landscapes in North America.