Bond

The Top 5 Things You Need To Know From the 2015 Loyalty Report

What's trending in loyalty?

The 2015 Loyalty Report saw an increasing number of people opt-in to a variety of loyalty programs in the past year, and revealed the extent to which programs are effective in influencing customer behavior show no signs of diminishing.

Here's a Top 5 list of what's trending in loyalty:

- Enrollment is up, despite a limited capacity for engagement. Meaningful year-over-year increases are observed on all key sentiment trackers:

- "Programs are definitely worth the effort"

- "Programs make me more likely to continue doing business with certain companies"

- "I modify when and where I make purchases in order to maximize the benefits I receive"

- "I modify what brands I purchase in order to maximize the benefits I receive"

- "Programs are part of my relationships with the brands"

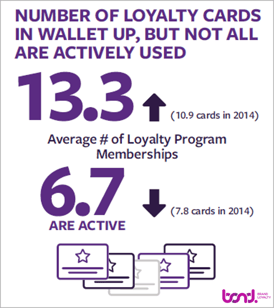

Even the average number of programs in which consumers are enrolled continues to climb—from 10.9 programs per Member in 2014 to 13.3 programs per Member in 2015. Yet customer participation (or lack thereof) in these programs tells a slightly different story: despite the increase in average enrollments, the average number of programs in which Members are active (i.e., make a purchase) has decreased from 7.8 to 6.7.

-

Marketers must focus on authentically fulfilling customer needs to break the habitual reliance on the discount-oriented value proposition. Program satisfaction correlates well with many of the desired outcomes that marketers expect from an investment in loyalty, such as the likelihood to continue doing business with the brand and recommend the program.

The functional elements of loyalty programs, including the ease with which rewards can be redeemed and amount accumulated per $1 spent, rank highly as drivers of program satisfaction. Yet relying on these functional elements is a pitfall to which many brands have succumbed—locking themselves into an endless cycle of one-upmanship and outspending the competition on rewards.

Marketers can reduce their reliance on monetary incentives by focusing on experience-based drivers of satisfaction—which are as weighty as functional rewards-oriented drivers in terms of their influence on overall program satisfaction.

-

The program must serve the brand, not just the program. The ultimate role of the loyalty program is to drive loyalty to the brand; it is not sufficient for programs to drive program satisfaction without fostering corresponding and sustained loyalty to the brand.

In what could be most telling about the status of brands and loyalty programs, 34% of customers say they would not be loyal to the brand if it were not for the brand’s loyalty program. Programs are seen as an extension of the brand by 76% of Americans who think that loyalty programs are part of their relationships with brands.

-

Mobile in loyalty not only improves the program experience, but ultimately drives loyalty to the brand. Mobile is a strategic high ground in loyalty—or at least it should be. It’s a combination of a communication conduit, unique identifier, and payment vehicle. Mobile adds utility to marketing as part of an improved customer experience in a way that loyal customers appreciate.

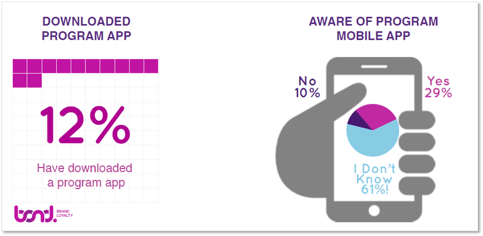

And yet there is contradictory data regarding whether consumers want to interact with programs via mobile. While 48% of Members agree, “I would like to engage with loyalty programs through my mobile device,” only 12% of customers have downloaded a program app, and 61% of smartphone owners are not even aware whether or not their program offers a mobile app. For brands with mobile loyalty apps already in play, there are benefits being achieved.

For instance, 62% of customers using the program’s mobile app are satisfied with the program, as compared to only 45% among Members who have not downloaded a mobile loyalty app.

While the role of mobile in loyalty is, in part, to improve the program experience itself, the higher-order objective is to improve the brand experience overall and, ultimately, drive loyalty to the brand.

-

Some of the most beloved brands have no formal loyalty program, yet lean on familiar loyalty design principles to achieve their covert and stealthy alternatives to formal programs. Marketers often cite brands such as Nike+, Apple’s iTunes Genius, and nest thermostat as benchmarks, because of their high customer loyalty. They achieve high levels of customer loyalty without an explicit loyalty program.

These informal approaches to loyalty have managed to avoid the loyalty “program” moniker, yet they have cleverly borrowed some of the familiar design principles of formal loyalty program design, including a mechanism that uniquely identifies customers, and interventions to encourage and reinforce behaviors.

What is compelling is that these brands have crafted a value exchange that is not solely reliant on a discount and monetary exchange, but rather on one that fulfills customer needs, makes customers feel recognized and valued, and engages through relevant and personalized experiences. In short, these principles help brands outperform by making the experience with the brand better, get customers to a place where they’re willing to pay a premium, and make them more loyal to the brand.

Download your free copy of the 2015 Loyalty Report Executive Summary.