Bond

Points Liability Management—Lowering The Tension Between Your CFO & CMO

Almost all currency-based consumer loyalty Program designs inherently house a financial liability, which in many cases has a material impact on a brand’s balance sheet. Generally speaking, a brand incurs liability for a future loyalty Program reward as soon as it issues the Program’s currency (e.g., points, miles, credits, stars, etc.) to a Program Member. From an income statement perspective, there is a reduction in revenue as soon as the currency is issued to a Program Member. As such, the brand cannot account for the full sale, since a percentage will need to be remunerated in the form of a reward (or dividend) back to the Program Member upon redemption. The accounting principles which govern financial liability management are not for the faint of heart, and they more than often create an ongoing level of tension between a brand’s CFO and CMO. CFOs wish to minimize their currency liability and resulting financial exposure, while CMOs wish to issue currency to incent incremental transactional behaviors with the aspiration of maximizing Member redemptions.

So, one must wonder, how can these financial and marketing disciplines find common ground? If you have ever been on either side of the fence, this tension should not come as a surprise. Don’t give up hope, as there are some plausible avenues by which to arrive at a mutually beneficial outcome and lower the tension between these two vested constituents.

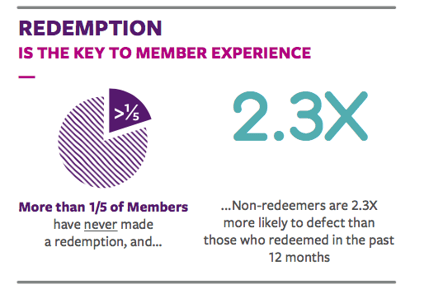

Qualitative and quantitative studies combined with transactional analysis strongly indicates that loyalty Program reward redemption is a key driver of customer satisfaction, and keeps customers engaged and loyal to the brand. According to the 2016 Loyalty Report, by Bond Brand Loyalty, Members who have recently redeemed for rewards have 2.5X higher program satisfaction levels compared to Members who have never redeemed. There is no doubt that redemption of rewards is a good thing for a brand and its Program Members. We also learn from this study that more than 1/5 of Members of loyalty Programs have never made a redemption, and non-redeemers are 2.3X more likely to defect from a brand than those who redeemed in the past 12 months. While this definitely makes a strong case for brands to encourage redemption, it can be expensive and building a liability on the books can increase financial risks.

Since loyalty Program rewards costs are incurred as soon as the currency is issued to a Member, a reserve liability must be set up immediately to remunerate the Member when they redeem their currency for rewards. So essentially what happens is that there’s an accounting entry that impacts the expense of the loyalty Program. Upon redemption, a percentage of the liability reserve is converted into cash to account for the redemption reward. Therefore, there is usually no impact to the loyalty Program expense at redemption as the expense is accounted for on issuance and not redemption. This in itself creates a challenge for the CFO and the CMO.

Many loyalty Program managers often employ point or mile redemption campaigns to stimulate Member transactional activity. These can take on many forms, such as discounts on the number of points needed to redeem, issuance of bonus points to achieve a reward threshold quicker, and many other such promotions. But does this really help to diminish the CFO’s liability concerns? Not always. For instance, points redemption burn campaigns may have taken points off the books and driven incremental sales, but the cost of those points was actually incurred when they were issued. From a financial liability perspective, this strategy acts to convert the liability to cash. Some would argue that this might not be an optimal outcome as CFOs prefer to retain cash as long as possible and not have to pay off the liability. Why would they want to pay off a debt sooner than required, as a currency liability is effectively an interest-free obligation to a Program’s Member base that has yet to be remunerated?

So, when the CFO wants to reduce his/her brand’s liability, they are in effect requesting the CMO to mitigate the elements which drive points liability higher. Specifically, managing the “accrual rate” and the “cost per point.” Reducing the accrual rate, which is effectively the proportion of points a brand can expect to see redeemed during the life of a point, can only be achieved by increasing the expected breakage rate. Well, we know that CMOs are generally not in favor of increasing the breakage rate as that means that a smaller proportion of the Member base will experience a reward redemption, and we know that redemption is a catalyst for Member satisfaction and brand engagement. So, we are really left with only two other options.

1. Reduce the cost per point.

Can a points redemption campaign lower the cost per point? It depends on the structure and outcome of the campaign. If the campaign can shift redemptions to lower cost per point rewards then this can be achieved, thus reducing the points liability reserve for a period of time. To sustain a lower reserve, the Program will need to be structured to drive redemption behavior change towards lower cost redemption options or a realignment of the rewards value.

2. Structural Program design changes.

This requires the Program owner to rethink Program features on the earn and burn side of the loyalty Program design. There are loyalty Program mechanics and reward options that are widely used that do not necessarily impact financial liability. In such instances, the cost of the rewards is funded through a marketing budget. For instance, providing exclusive access to special coveted experiences such as Member-only events, early access to merchandise or services, and entry into contests will not build a liability as they are funded through a fixed marketing budget. Points could act as an unlock (e.g., eligibility) determining which Members can take advantage of these benefits, reducing expense exposure in some instances. Points are not being redeemed but act as an indicator to the brand which Members are eligible for a suite of benefits. Usually this is achieved by Program tiers which are generally calculated on spend or the number of points earned in a defined time frame.

Brands in search of solutions to minimize the risks associated with points liability often seek out the guidance of unbiased loyalty agencies for strategic counsel to land on an appropriate strategy that can satisfy the concerns of both the CFO and CMO. Structural changes to a loyalty program for financial purposes need to be assessed holistically as they can have significant implications on Program efficacy and resulting Member engagement. Points liability management is more important than ever as brands face increasing competition from non-traditional channels. Managing the Program liability needs to be a joint effort between a brand’s marketing and finance teams, using Member and financial data and insights to arrive at optimal loyalty Program strategies. While there are a number of partial remedies available to brands to manage liability, this activity needs to be closely monitored to ensure that the loyalty Program value proposition remains compelling, relevant, and engaging in the face of a highly saturated loyalty Program market place. Consistently assessing the efficacy and efficiency of a loyalty Program is a strategic imperative, as it is critical to cut through the marketplace clutter to stay relevant with the Program’s Member base. Managing financial liability must be a key consideration and goal when evaluating a loyalty Program proposition. More often than not much of the focus is placed on marketing enhancements first while consideration for financial resources is only contemplated at the tail end which serves only to trigger further tension and rework time to the Program.

Should you have any questions about this topic or require strategic loyalty Program counsel, feel free to reach out to me at richard.schenker@bondbrandloyalty.com.

To learn more about trust and satisfaction in loyalty programs download a copy of the Executive Summary of the 2016 Bond Loyalty Report.