Bond

Paid Memberships Are the New Loyalty in Retail

Update on the Rise of Paid: Our Loyalty Report 2019 research found that interest in paid memberships continue to rise. 43% of members are willing to pay a fee for enhanced benefits.

As featured in TotalRetail.

“To fee or not to fee?” will be the question many retailers ask themselves this year, as paid loyalty programs steadily take hold. While the paid model isn’t new — Costco is a pioneer in this space and game-changer Amazon Prime launched back in 2005 — more retailers are viewing pay-to-play as a compelling option for both members and their businesses. Restoration Hardware, GameStop, Bed Bath & Beyond, and GNC have all jumped on board, and the pay-to-play movement will only grow from here.

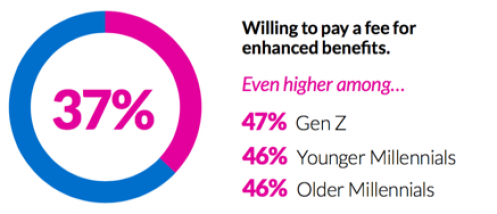

While members are used to getting rewards for free, a meaningful proportion of consumers now agree certain perks are worth paying for. In The Loyalty Report 2018, which surveyed 16,000 consumers in the U.S., 37 percent said they're willing to pay a fee for enhanced benefits in a loyalty program. Gen Z consumers (47 percent) and millennials (46 percent), as well as households with children (44 percent) and early technology adopters (69 percent) are even more willing to pay for premium loyalty programs.

The Loyalty Report 2018

What’s in it for members who pay to be in a loyalty program? Many paid programs offer benefits such as free shipping, members-only pricing, and exclusive access to sales. GNC’s premium membership, for example, includes “Pick-Your-Sale Days,” giveaways and “Pro Boxes” with samples and coupons delivered to members’ doors twice a year. The $40-a-year program seems to tick the box on what makes a paid tier successful: high-perceived value for members and low cost for the business to fulfill.

Restoration Hardware is another example of a high-value paid program. For $100 a year, the RH Grey Card offers members complimentary interior design services, reduced interest rates on the RH credit card, as well as 25 percent savings on all regularly priced merchandise and 20 percent off sale items.

While it may seem questionable how a retailer that sells $4,000 couches can afford such big discounts, there’s a clever business advantage here. With in-home design consultations included within the for-fee benefits, loyalty members ensure they’re getting the right furnishings for their homes, eliminating the expensive problem of returns for Restoration Hardware. On top of that, members’ level of confidence and satisfaction goes up, and the human experience fosters a real emotional connection with the brand.

For retailers, one of the most compelling reasons to consider paid memberships is additional revenue. Even if only a small percentage of members elect to pay a fee, it could add a significant amount of funding to the program’s operating budget. This allows retailers to afford more benefits for their best customers, ensuring these members will stay engaged with the program and brand year after year.

Paid tiers also help retailers stay high in the customer’s consideration set. When customers pay to belong to a loyalty program, they're committed to that particular brand and will engage more regularly. Retailers also gain valuable data about their top-tier customers, and the insights can be leveraged for more personalized experiences.

Given the range of viable benefits, perhaps the salient question for retailers isn’t “to fee or not to fee?” but rather “which segment of our member base is a paid tier right for?” As our Loyalty Report shows, consumers continue to join more loyalty programs, but are not active in all of them. To be one of the chosen active programs, brands need to evolve traditional programs and take loyalty to the next level.

For retailers already operating pay-to-play loyalty programs, the key is to not just “set it and forget it.” As the paid loyalty space gets more competitive, it’s imperative to continue to provide high-value benefits to members. The retailers that do will be the ones that reap the rewards in the new loyalty revolution.

Scott Robinson is vice president, design and strategy, Bond Brand Loyalty, a brand loyalty, marketing and consulting firm.