Bond

Insulating Your Loyalty Program During an Economic Downturn

The past year has been characterized by unprecedented global inflation across key sectors, including food, energy, and household commodities, just to name a few. Among the contributing factors: a continued workforce shortage, supply chain issues, and geopolitical instability. Additionally, to stem inflation and to cool down the housing market, federal or central banks have ushered in several interest rate hikes, which have made it more financially difficult for existing variable rate mortgage owners. As one would expect, this all has had a profound negative financial outlook for most of the economies around the globe. As a result, many consumers have had to rationalize and reduce their spending in key business sectors.

What we learned from the pandemic

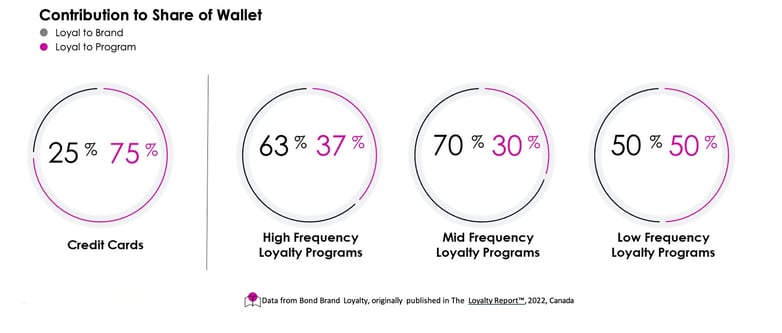

During the peak of the pandemic, many brands pivoted their loyalty strategies to be more in tune with their customer’s needs. We believe many of the lessons learned from the pandemic can be proportionately applied to today’s economic slowdown. In most sectors, loyalty programs act as a key influencer in a consumer’s decision to spend money with a brand. In fact, for the financial services sector, 75% of consumers say they are loyal to the credit card’s loyalty program and only 25% are loyal to the bank’s (The Loyalty Report 2022). While this sentiment is not as extreme in the retail sector, there is a range of 30%–50% prioritization by consumers to the brand’s loyalty program vs. the brand proper.

So, loyalty programs are most certainly a strategic business asset that needs to be examined during any economic downturn. In categories with risk of constricted spending or attrition, they are an even more valuable asset.

The loyalty program health check.

#1 Assess the program’s current loyalty strategy and value proposition

#2 Changes to the Programmatic Structure and Mechanics

#3 Finding new program benefits through a review of a Brand’s Asset Ecosystem

#4 Optimization of the Program Experience

#5 Calibration of Loyalty Financials

During these uncertain times, it’s important that your loyalty solutions are optimized, highly sensitive to your members’ financial predicaments, and are operating at peak efficacy to retain and foster strong transactional and emotional relationships with members. Our experts at Bond recommend the following foundational guidance to ensure you can achieve exactly that:

#1 Assess your programs current loyalty strategy and value proposition

Gauge the degree to which your current loyalty strategy and value propositions are best addressing and servicing your program members.

Ask the following questions: Is the program’s value proposition still relevant to these key member cohorts? Will the loyalty program continue to succeed in achieving the brand’s key performance indicators during the economic downturn?

Brands need to be more precise and relevant and not paint all customers with a broad brush. For instance, in the credit card loyalty space, it makes little sense for a card issuer to push aspirational travel rewards to cardholders who have shown a decline in card spend and are having challenges with making ends meet. That does not mean they should abandon this strategy with the entire card portfolio, but rather be more targeted with customized messaging and campaign execution. A more suitable strategy would be to invest in attainable and tangible “everyday” rewards for this impacted segment. Perhaps lowering the redemption threshold required to earn free groceries, pharmacy products, and fuel would be much more strategic and relevant for this segment. This can help members stretch their everyday dollar spend. For the bank, it is likely a win-win scenario, as customarily their cost per point redeemed is more advantageous on everyday spend categories compared to securing airline seats for redemption. These types of strategic value proposition pivots can reduce a brand’s financial exposure, be more meaningful and relevant for members, and fortify transactional and emotional loyalty during an economic downturn.

Similarly, for a high frequency retailer, there are behavioral signals that can be gleaned from transactional data that allow a brand to be proactive with its customers. Let’s take the grocery sector as an example. We often say in grocery that “you are what you eat.” An astute traditional grocer can glean actionable insights when they examine certain segments of their membership base who are exhibiting new behavioral patterns such as:

- A reduction in spend on fresh produce;

- Lower spend or no longer spending on ready-to-eat products;

- A shift to private label products from recognized brands;

- Less meat purchasing and more lower-cost meal options;

- An increase in the proportion of products purchased on discount; or

- A reduction or elimination of spend on stock up items also sold at “big box” or value retailers.

These are all indicators of restricted spend at a grocer. To retain this customer base and expand its purchasing, the grocer should redirect promotional store-wide funding to these impacted customers through their loyalty program to help mitigate further decline in transactional spend. Additionally, the loyalty program currency can be directed to offer bonusing on key SKUs and categories to help these members get to free groceries faster, ideally funded by suppliers and vendors. A smart vendor-funded strategy can be used to appropriately invest in similar customers who are at risk, rather than invest in members who might not change their purchasing behavior, regardless of what incentives are put in front of them. A change in co-op investment strategy can often pay dividends to retain business and help impacted members.

#2 Changes to the Programmatic Structure and Mechanics

Consider ways in which members can extract value out of their loyalty program.

During the pandemic, several brands made structural changes to eligibility criteria and program mechanics to be considerate of members’ financial predicaments. For instance, airlines extended status renewal terms, some bank credit cards waived late fees and service charges and several retailers extended redemption expiries. These overt and empathic programmatic changes were often made democratically across all members and garnered goodwill.

The sentiment that brands have their customer’s back can be a very powerful and lasting loyalty builder. While we are not advocating that brands invoke these measures across the board to all members during an economic downturn, brands should consider discretionary considerations such as these for cohorts of program members who are experiencing economic hardship. Such actions can provide some relief to program members and act as a lever to maintain their business with these brands.

As with any such decision, it is vital to forecast the financial impact of such structural and mechanical changes. It is equally important, once these decisions are made, to fully empower frontline staff and service representatives to execute these measures, accompanied by the right checks and balances to mitigate any abuses.

Brands should also consider ways in which members can extract value out of their loyalty program quicker. Loyalty operators should be shouldering some of this economic relief and sharing the financial burden with their vendors and suppliers. When a customer trades down or leaves a retailer, there is usually a downstream impact for suppliers and vendors of the brand. So, it stands to reason that this should be addressed in a collaborative fashion.

#3 Finding new program benefits through a review of a Brand’s Asset Ecosystem

Take stock of the assets brands have in their business ecosystem that may or may not be fully utilized.

Such an assessment often unearths valued assets in the business that are underutilized and could be better served if they were made available exclusively for loyalty members or for a subsegment of economically challenged members. Special services, privileges, access, and unpublished benefits are just a few types of assets that are possibly available at large to the general population, but that can be better served if made exclusive in the loyalty program. Often, these assets are already paid for by the brand and, therefore, there is no incremental cost to direct them to members only. Whether free services, access to better pricing, extended return policies, or fee waivers, offering these benefits to impacted members can help reduce their financial burden and garner greater loyalty.

Similarly, brands have strategic partnerships and sponsorships with adjacent and complementary businesses. Examining the ecosystem of benefits inside these relationships and the extent to which the benefits of these sponsorships and partnerships can be extended to members only, or specifically to affected members, is a worthwhile exercise.

#4 Optimization of the Program Experience

Eliminate customer pain points in the loyalty journey and facilitate even more enjoyable and valuable loyalty experiences.

The type of loyalty program experience that a brand affords its customers is increasingly more important than ever. Customers place a high value on a brand’s loyalty program when deciding where to transact. This is of heightened importance when customers have limited financial means and are making economic trade-offs. For brands that make it hard for financially struggling members to participate in their programs by limiting a member’s ability to extract tangible value, or by complicating the loyalty experience, the result can be members who are far less forgiving. We advocate that during difficult economic times, brands ensure that they are working even harder than they typically might to eliminate customer pain points in the loyalty journey and facilitate an even more enjoyable and valuable loyalty experience.

This is an optimal time for brands to renovate and/or innovate their loyalty program experience. This can come in the form of new and more intuitive processes, new technologies that make it easier to engage with the loyalty program and the brand, or simply affording frontline staff increased flexibility to make the experience more enjoyable for customers.

According to our study, when a brand’s loyalty program makes the brand experience better, members are more likely to say good things about the brand to others. In fact, customers are almost 5× more likely to recommend the program, if asked. They are 6× more likely to continue to do business with the brand when they have a positive loyalty program experience. What’s more, they are 4× more likely to spend more money with the brand and 4.5× more likely to be loyal to the brand. These metrics should be more than sufficient reason for brands to reassess their loyalty program member experience and ensure they are getting it right with their members, especially when members have less patience for program missteps.

#5 Calibration of Loyalty Financials

Examine the expected financial returns of your program features.

The loyalty program recalibrations that a brand decides to make to its strategy, value proposition, and member journey, even temporarily, for a segment of its member population can have a profound impact on program financials. As such, it is important to examine the expected efficacy in the context of the financial returns on such decisions. It is equally important to ensure that the brand has the latitude to sunset such changes as it sees fit.

Brands’ CFOs are often worried about their program’s liability on balance sheets, while CMOs see loyalty programs as an effective and efficient means to drive sales. Changes made by the program’s CMO can have an impact on points breakage and the cost per point of a loyalty program. Often such changes can change the economic outlook of a program. This tug of war between organizations’ CFOs and CMOs is present in good economic times but is even more strained during challenging economic times. Organizations must seek a collaborative approach that balances the needs of the business to retain customers and the need for fiscal responsibility.

Brands have a strategic and financial opportunity to ensure they are constantly re-examining the efficacy and relevancy of their loyalty programs for key member segments. This is of paramount importance as we all weather the economy.

Bond works with leading global brands to maximize their loyalty strategies and value propositions. To help our clients move quickly, we have a formalized and proven Loyalty Program “Health Check” service that examines all dimensions of a loyalty program. It includes recommendations on customer-centric solutions to protect your loyalty investment during economic downturns and beyond. For more information on what a Loyalty Program “Health Check” looks like for your business, reach out to us at info@bondbl.com.