Rob Daniel & Maegan O'Neill

BMO acquires Air Miles loyalty program rewards

Friday morning our offices were buzzing with news that Loyalty Ventures and BMO have entered into a purchase agreement for BMO to acquire Loyalty Venture’s AIR MILES Reward Program. For those of us active in this space, this has been anticipated and contemplated as a possible outcome for quite some time, but that doesn’t blunt the importance of this news. This is a major event in the Canadian Loyalty and Credit Card Landscape. We’re being asked for our reflections by media, marketers and program operators across the country and in varied sectors. Below are some initial considerations you might find useful.

BMO and Air Miles

BMO and Air Miles

BMO and Air Miles have been partners since the reward program’s inception in 1992. Since then, Air Miles has seen tremendous growth in Canada as one of the country’s most prolific loyalty programs, viewed around the world as a highly valuable mechanism for driving customer behaviors. While BMO has been working to diversify value propositions within its credit card portfolio, the BMO Air Miles MasterCard and BMO World Elite cards continue to be very important components of its portfolio. For Air Miles, BMO is the essential anchor in its coalition offering to consumers and merchants.

Air Miles trained Canadians on coalition loyalty, maximizing opportunity across sectors and frequencies of spend with one shared currency for the greatest value potential. Even as the landscape has shifted over the past several years, the desire for consumers to earn shared currency across categories is reflected in the growth of a number of programs and the partnerships that connect some of the country’s largest loyalty solutions. These partnerships, alongside overcoming the ubiquity of value propositions, have continued to build the level of competition amongst everyday spend brands and credit cards.

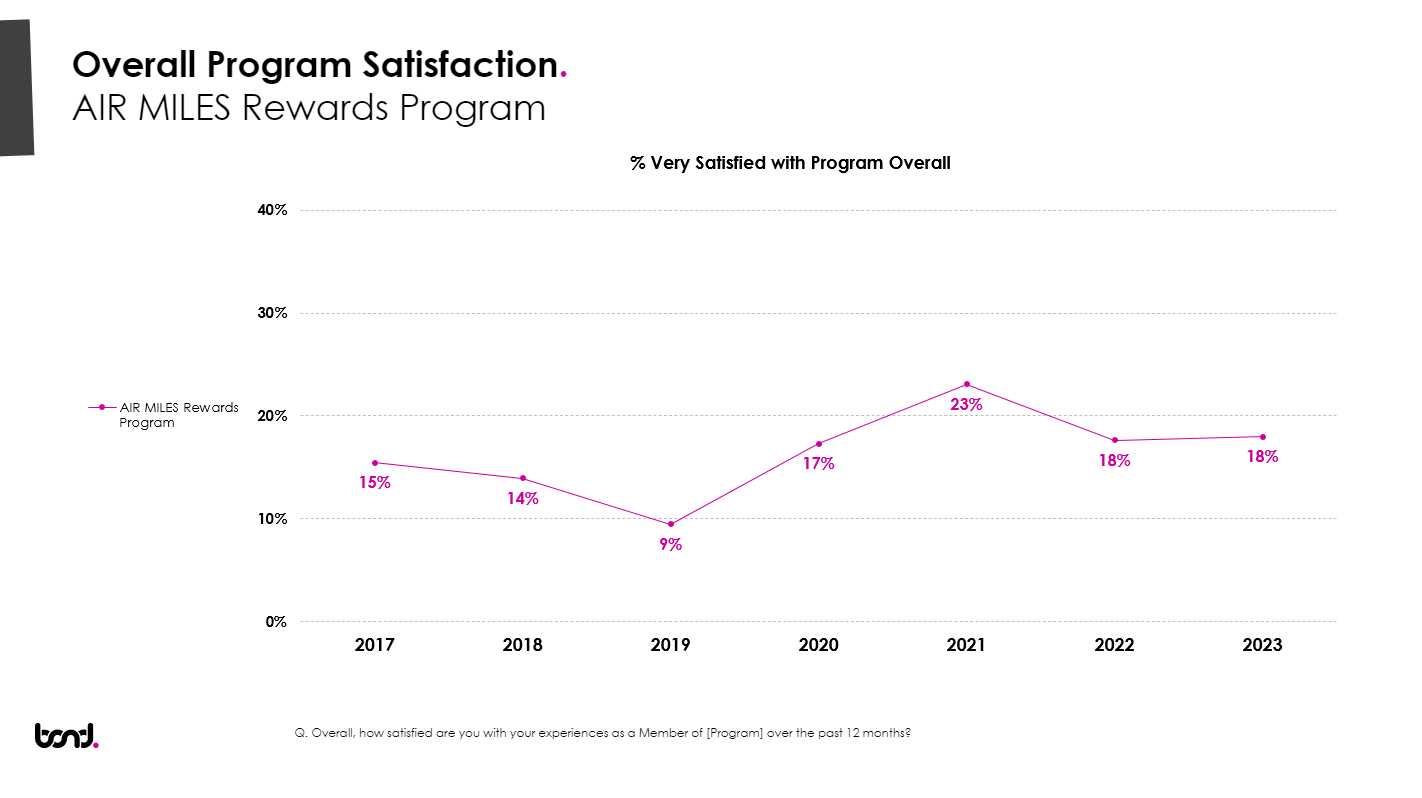

Challenging few years for Air Miles

Recent history hasn’t been easy on the Air Miles value proposition. BMO became even more essential in recent years as a number of key earn-and-burn partners such as Empire Ltd. (Sobeys), LCBO, RONA and Staples ended their relationship and pursued other programs and solutions. Leading up to COVID in March 2020, the program suffered through a number of years recovering from a highly publicised consumer protest tied to new points expiry rules, followed by complaints tied to varied actions that devalued the currency in ways that weren’t always transparent to the member. At the same time, merchant partners were demanding more value from data being collected while former parent company, Texas-based Alliance Data Systems (ADS), was simultaneously eager to reinvigorate profit. Air Miles, once a national leader, was quickly losing relevance and disappointing consumers, merchant partners and shareholders. Once valued at over $300 a share when blended with ADS family of companies, stock value currently hovers around 20 cents per share.

While this was happening, other merchant and credit card loyalty programs were growing in relevance. Consider a backdrop that saw tremendous growth for travel credit card programs like CIBC Aventura and RBC Avion portfolios, along with explosive success for Scene+ and PC Optimum.

Loyalty and Engagement Marketing continues to be an essential driver of consumer behavior

For years, Bond’s annual Loyalty Report (TLR, the world’s largest study of consumer attitudes and behaviors associated with Loyalty programs) has continued to confirm the value of loyalty programs. Merchants use programs as an essential CRM and offer management tool, and credit card operators know from our study that the number one driver of credit card choice and purchase volume is a well-designed and relevant program offering. Canadians continue to love their programs. BMO, with a portfolio highly tethered to Air Miles, needed a solution, and Canadian marketers began chattering about possible alternatives—knowing one was needed.

Loyalty matters

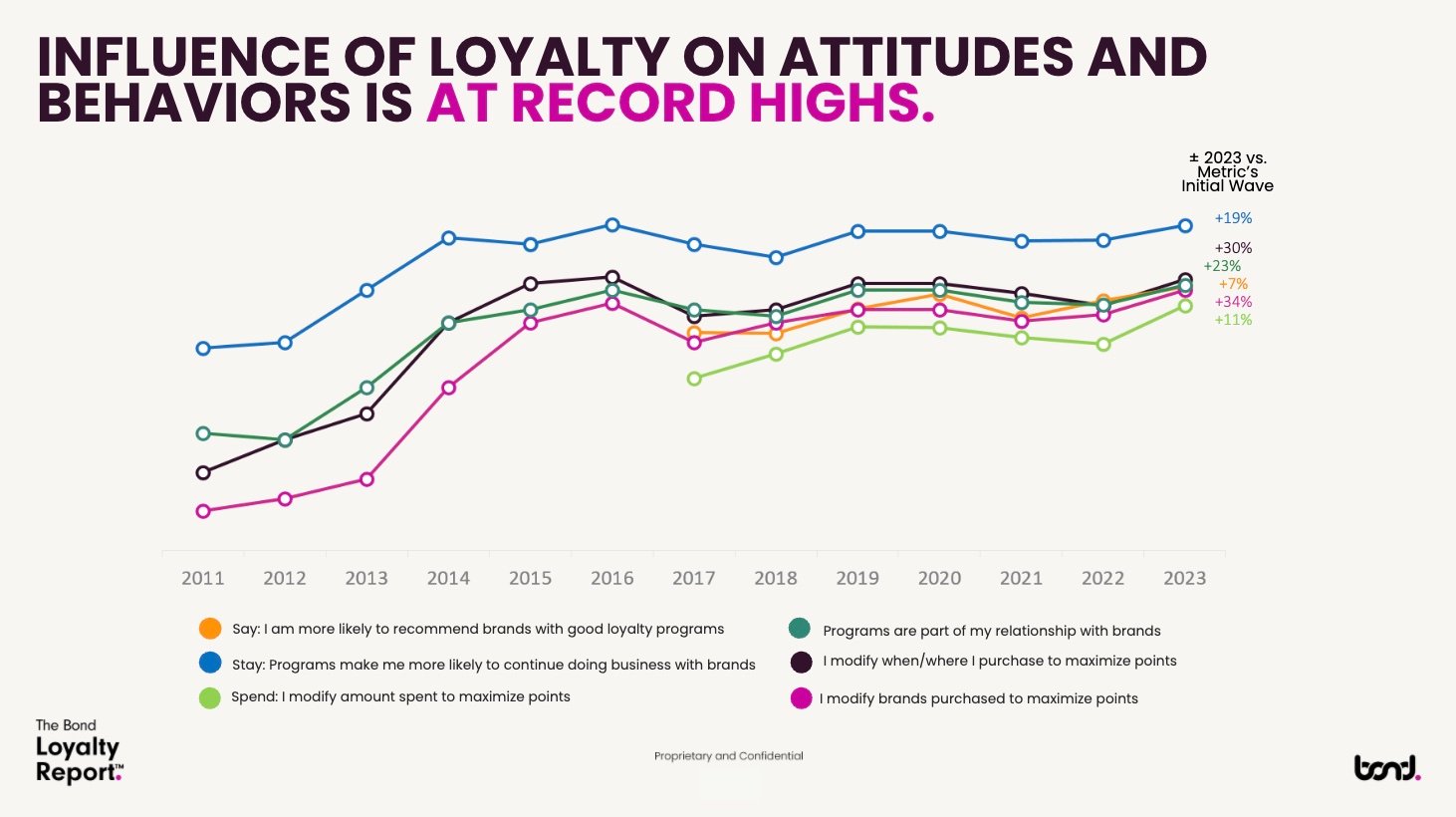

The results of the 2023 TLR study, just out of field in Canada, show intentions to continue doing business with the brand; modifying spend to maximize points and modifying the brands purchased to maximize points are at their highest levels ever. As more and more formal loyalty programs enter the market, competition within the consumer’s wallet increases, and differentiation can become a bigger challenge. Still, growth indicates consumer appetite and willingness to try new programs.

As more and more formal loyalty programs enter the market, competition within the consumer’s wallet increases, and differentiation can become a bigger challenge. Still, growth indicates consumer appetite and willingness to try new programs.

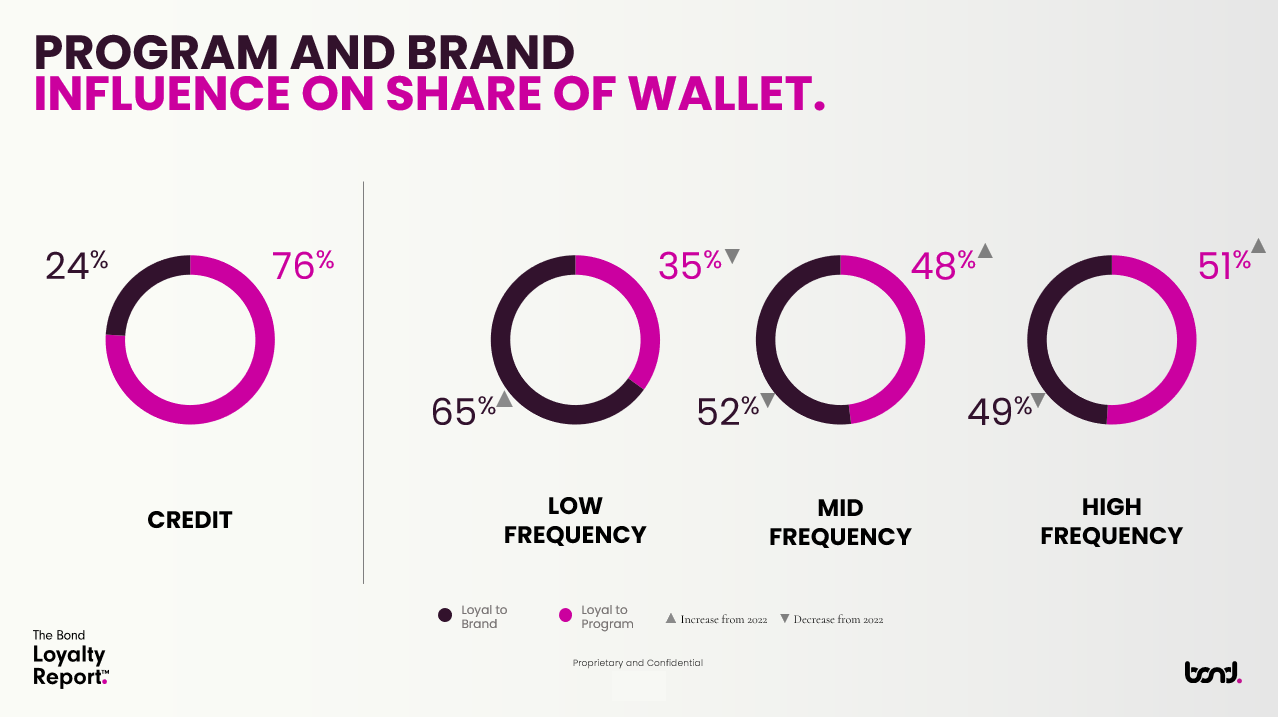

The influence of programmatic loyalty on share of wallet within the credit card sector is most pronounced. The program is the product when it comes to payment. BMO’s Air Miles portfolio continues to be represented in TLR’s top ten travel credit cards, particularly in the premium travel space, indicating this portfolio continues to be one of value for the bank, with tenured cardholders who retain the card even as new competitive products enter the space. This also identifies these cardholders as potentially high value conquests for other credit card issuers. Canadians only carry an average of 1.4 payment cards per person. Therefore, replacing a primary card is both a challenging and highly valuable opportunity. Creating confidence quickly is essential to BMO retaining this existing base.

BMO’s Air Miles portfolio continues to be represented in TLR’s top ten travel credit cards, particularly in the premium travel space, indicating this portfolio continues to be one of value for the bank, with tenured cardholders who retain the card even as new competitive products enter the space. This also identifies these cardholders as potentially high value conquests for other credit card issuers. Canadians only carry an average of 1.4 payment cards per person. Therefore, replacing a primary card is both a challenging and highly valuable opportunity. Creating confidence quickly is essential to BMO retaining this existing base.

Bond’s Advice to BMO as the new owners of Air Miles

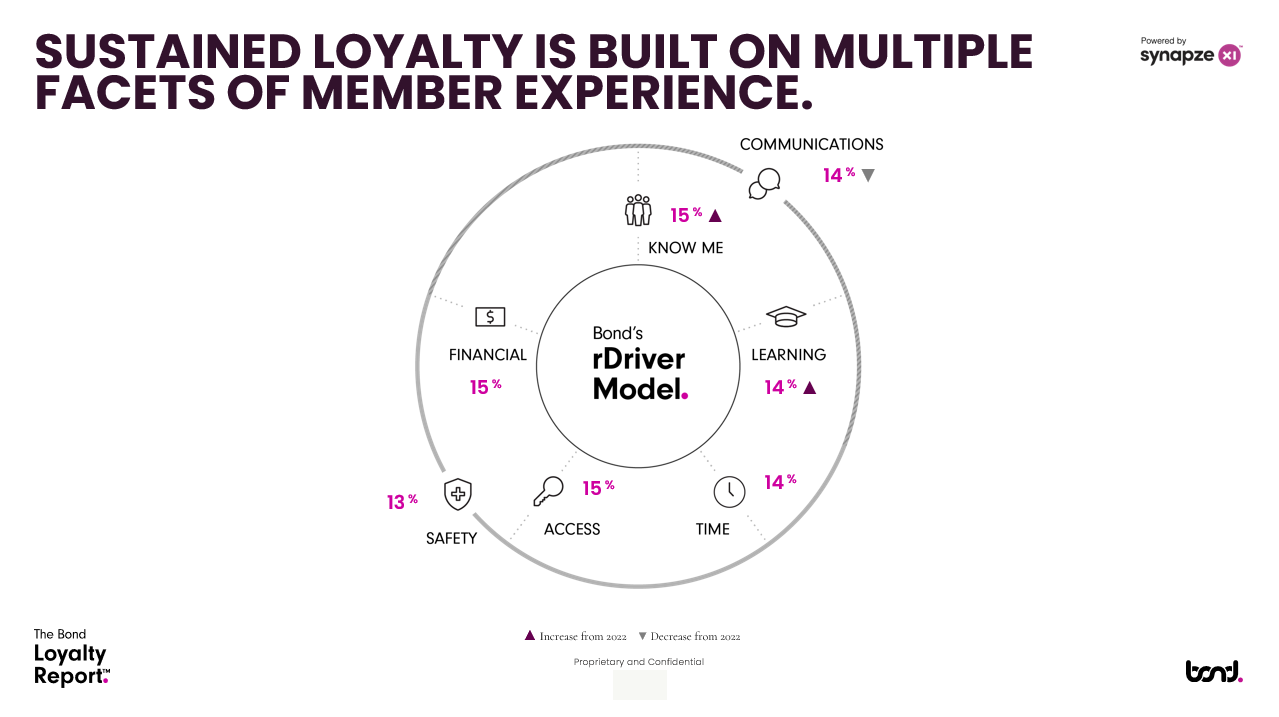

Air Miles is a program needing a reset with consumers. This should include careful consideration of offering beyond currency value as there are multiple aspects of loyalty value proposition that influence “loyal to program” and “share of wallet”.

For BMO, the focus is on quickly articulating the new course for the storied program, with confidence and a clear outlook that members can buy into. The Air Miles credit card products have gone through changes that have seen programmatic devaluation as recently as last month. BMO will need to demonstrate commitment and re-establishment of the value on these products quickly. Building relevancy through utilization of data to drive a personalized journey for members and cardholders is essential. A key influence on Loyalty to Program is ‘Know Me’ focused on all areas of personalization, which is equal in importance to financial benefits. BMO will need to ensure the program is also relevant to merchant partners and resist the urge to see it become excessively oriented to the bank’s needs at the expense of others.

For BMO, the focus is on quickly articulating the new course for the storied program, with confidence and a clear outlook that members can buy into. The Air Miles credit card products have gone through changes that have seen programmatic devaluation as recently as last month. BMO will need to demonstrate commitment and re-establishment of the value on these products quickly. Building relevancy through utilization of data to drive a personalized journey for members and cardholders is essential. A key influence on Loyalty to Program is ‘Know Me’ focused on all areas of personalization, which is equal in importance to financial benefits. BMO will need to ensure the program is also relevant to merchant partners and resist the urge to see it become excessively oriented to the bank’s needs at the expense of others.

So what is next?

BMO will gain some emotional loyalty and halo for “rescuing” the program, given its history in the loyalty landscape and continued participation of almost 10MM Canadians. But the opportunity is ripe for other programs to step in to replace the everyday spend value proposition and for credit card issuers to offer ‘new’ experiences and differentiated value for Air Miles cardholders. The Canadian landscape is incredibly competitive and this signals that it’s go time for those looking to attract new cardholders to their base.

Given the potential tenure of these members, brands should consider the following:

- A clear earn proposition on everyday spend

- Rewards with flexibility for both immediate redemption at retail and long-term value towards travel

- Recognition of the potential value — an acquisition offer specific to Air Miles members such as a status match or bonus to accelerate initial time to reward

For more information we’re here to help.

Rob Daniel, EVP Client Leadership, & Maegan O’Neill, Managing Director Global Insights

About Bond

Bond generates growth for clients by creating enduring relationships between people and brands based on intelligent connections and engaging experiences. Guided by insights from advanced research and practical commercial application through the Bond Behavioral Institute, and enabled by technology through its proprietary cloud Synapze platform, Bond serves clients globally with customer experience and loyalty solutions—enabling brands, customers, employees, partners and the communities they serve to experience the benefits of growth. Headquartered in Toronto, Bond is management-owned with more than 800 people and eight offices across North America and Europe. For more information, visit us at bondbl.com or follow us on LinkedIn, Twitter and Instagram.